Guarantee With Confidence: Discover Tailored Insurance Coverage Providers for Unparalleled Tranquility of Mind

Are you trying to find insurance policy that is especially developed to fulfill your distinct needs? Look no further. With our customized insurance coverage services, you can insure with confidence and delight in unparalleled satisfaction. We understand that everyone's way of life is different, which is why we provide tailored insurance plan that fit your specific needs. Discover the benefits of individualized insurance coverage and discover the right insurance policy service provider for you. Don't wait any type of longer - attain comfort with our extensive insurance policy remedies.

Understanding Your Insurance Policy Demands

You need to comprehend your insurance needs so that you can choose the best coverage for your certain circumstance. Insurance policy is not a one-size-fits-all option, and it's crucial to analyze your individual scenarios prior to making any type of choices. These are all essential inquiries to ask on your own when determining your insurance policy needs.

Lastly, consider your budget plan. Insurance premiums can differ relying on the insurance and the coverage carrier. It is essential to discover an equilibrium between the coverage you need and what you can manage. Evaluate your economic circumstance and figure out exactly how much you're prepared and able to invest on insurance premiums. While it's crucial to conserve money, it's equally essential to have adequate coverage to safeguard yourself and your possessions.

Tailoring Insurance Plans to Fit Your Lifestyle

When it comes to fitting insurance policies to your way of living, we have actually obtained you covered. At our insurance firm, we recognize that each individual has unique requirements and choices.

For the daring hearts that love to discover the outdoors, we offer thorough coverage for all your exterior tasks. Whether you take pleasure in hiking, snowboarding, or even extreme sporting activities, our insurance policy policies will give you with the comfort you require to completely appreciate your adventures.

If you're a house owner, we have insurance policies that can protect your most valuable asset. From coverage for all-natural catastrophes to obligation defense, we'll make sure that you are well-prepared for any type of unforeseen scenarios.

For those that prefer an extra unwinded way of life, we have insurance policy alternatives that cover all your demands. Whether you're a collection agency of art or a wine connoisseur, we can provide you with specialized protection to shield your beneficial possessions.

With our customized insurance services, you can have unmatched tranquility of mind understanding that you are fully safeguarded. Contact us today and let us aid you locate the insurance coverage plan that fits your way of living like have a peek at this website a handwear cover.

The Advantages of Personalized Insurance Coverage

Our individualized insurance coverage provides many advantages to fit your distinct lifestyle. When it comes to protecting what matters most to you, having a policy that is tailored to your certain needs can make all the difference. With individualized coverage, you can have comfort recognizing that you are safeguarded in case of unexpected situations.

One of the major advantages of customized insurance coverage is that it permits you to choose the protection choices that are most important to you. Whether you require insurance coverage for your home, car, or other useful assets, our personalized policies can be customized to fit your certain requirements. This implies that you just pay for the insurance coverage that you really need, conserving you money in see page the future.

Another benefit of customized insurance coverage is the versatility it uses. Life is frequently transforming, and your insurance requires might change along with it.

In enhancement to these benefits, individualized insurance coverage likewise offers outstanding client service. Our team of knowledgeable specialists is dedicated to providing you with the greatest level of solution and support - Insurance Agency Eden Prairie. We are below to address their website any type of concerns you might have, aid you with claims, and make certain that you have the insurance coverage you require when you need it

Discovering the Right Insurance Policy Company for You

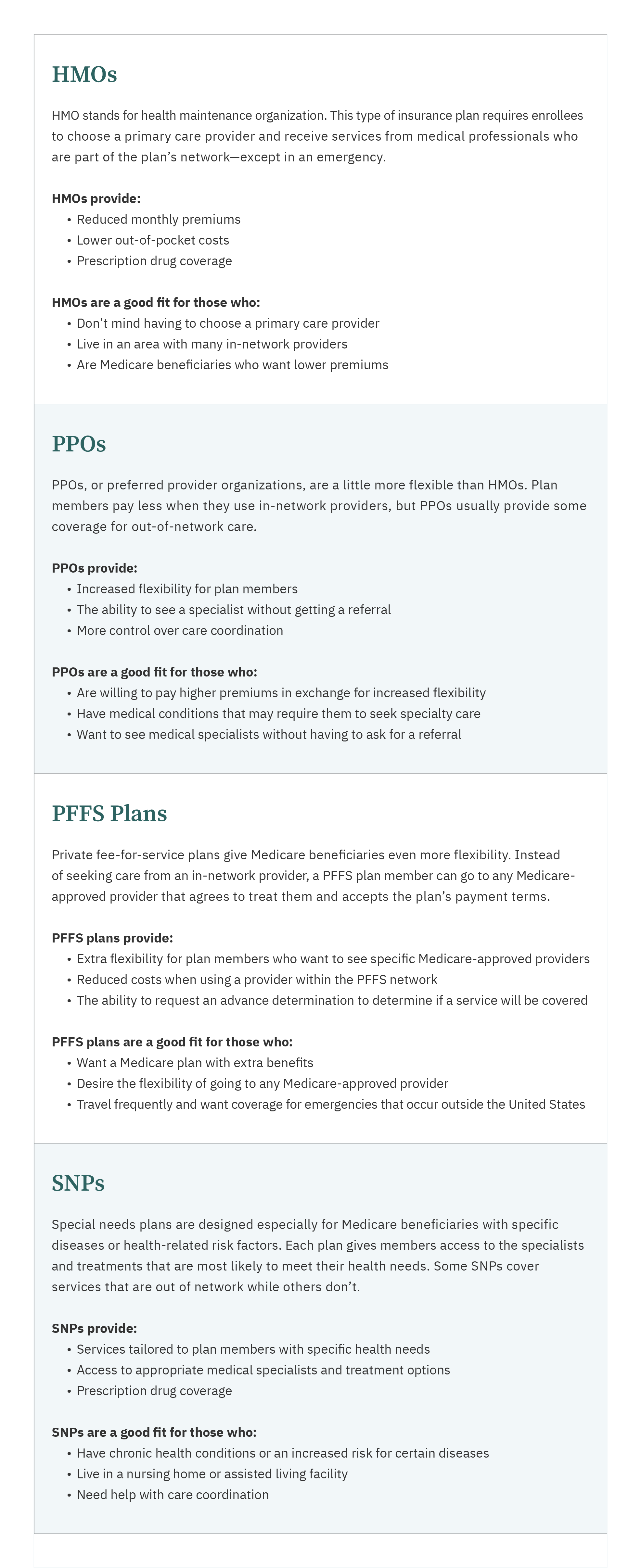

Finding the right insurance company can be a challenging task, however it's necessary to make certain that you have the insurance coverage that satisfies your specific demands. Do you require automobile insurance policy, home insurance coverage, or maybe both? By taking the time to discover the right insurance service provider for you, you can have peace of mind knowing that you are effectively safeguarded.

Achieving Assurance With Comprehensive Insurance Solutions

Having thorough insurance policy protection can give you a complacency and protection. When unanticipated occasions happen, such as crashes, natural disasters, or burglary, having the ideal insurance policy can aid offer and decrease the economic problem satisfaction. With thorough insurance coverage solutions, you can relax easy knowing that you are financially shielded against a wide variety of threats.

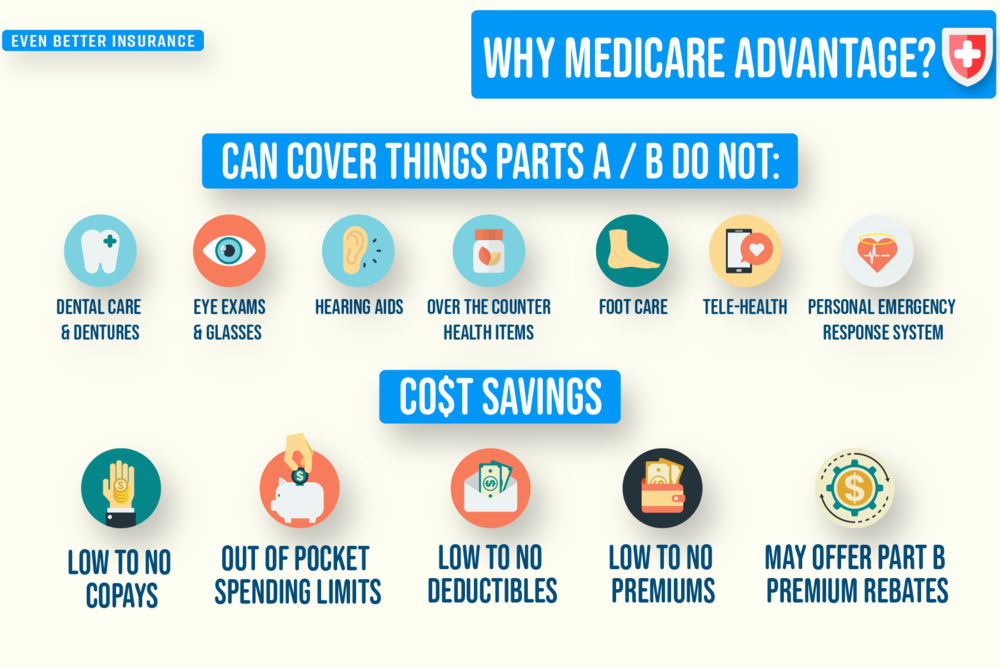

One of the major benefits of detailed insurance policy is its ability to tailor coverage to your particular demands. Insurance coverage carriers use various levels of coverage, permitting you to choose the one that matches your lifestyle and budget. By working carefully with an insurance expert, you can personalize your plan to include the particular defenses that matter most to you.

Final Thought

With customized insurance policy services that fit your way of living, you can enjoy unrivaled tranquility of mind. Don't resolve for generic insurance coverage - find an insurance policy provider that comprehends your special demands and uses thorough solutions.

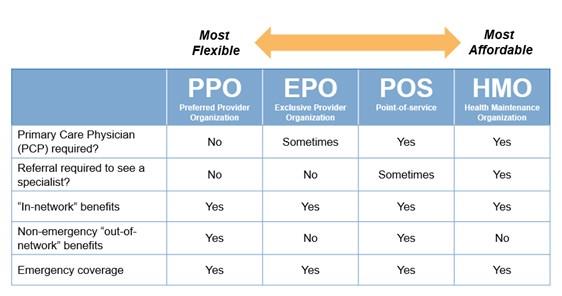

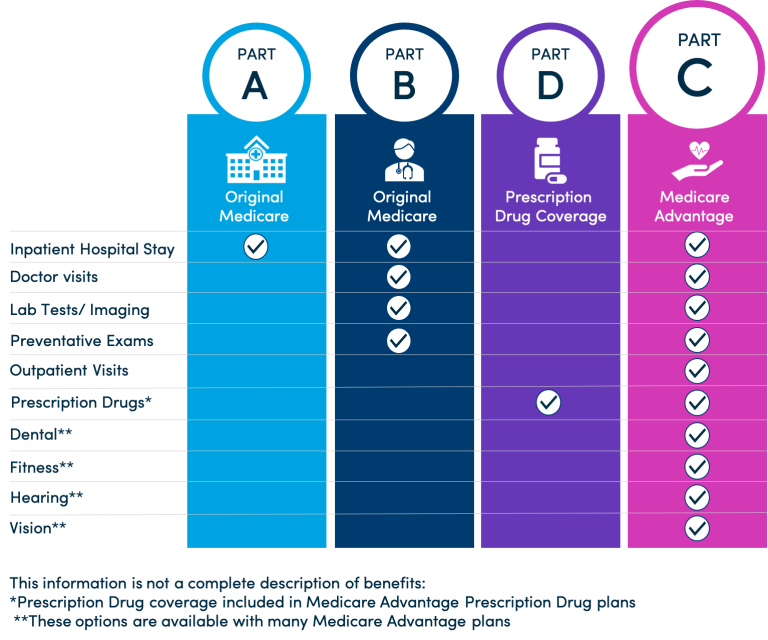

You require to understand your insurance requires so that you can pick the appropriate insurance coverage for your particular situation. There are different kinds of insurance policy policies, such as wellness, life, home, auto, and company insurance. Insurance coverage costs can vary depending on the insurance policy and the coverage carrier.One of the primary advantages of customized insurance policy protection is that it permits you to select the insurance coverage choices that are most vital to you. Do you require car insurance, home insurance coverage, or maybe both?